In today’s fast-paced business environment, companies of all sizes face challenges when it comes to payroll, human resources (HR), and compliance management. For small businesses to large enterprises, the need for a streamlined, efficient solution is crucial. Paycor, a leading provider of payroll and HR software, has been at the forefront of addressing these challenges with a comprehensive suite of tools designed to simplify payroll processing, ensure tax compliance, and improve HR operations.

What is Paycor?

Paycor is a cloud-based platform that offers a range of services tailored to streamline HR and payroll functions for businesses. Founded in 1990, Paycor has evolved from a regional payroll processor into a comprehensive HR solution provider, catering to companies of all sizes, industries, and geographic locations. The company’s software integrates payroll processing with HR, benefits administration, recruiting, time tracking, and workforce management, enabling businesses to operate more efficiently while reducing administrative burden.

Key Features of Paycor

Paycor offers a broad range of features designed to meet the complex needs of modern businesses. Below are some of the most prominent features:

1. Payroll Processing

At the core of Paycor’s offerings is its robust payroll processing system. Paycor’s payroll platform automates key processes, including:

- Accurate Payroll Calculations: Paycor ensures employees are paid correctly by accurately calculating wages, bonuses, overtime, and deductions. The system supports multiple pay schedules, from weekly to bi-weekly, and offers flexibility in adjusting employee pay rates.

- Tax Filing and Compliance: Paycor handles all aspects of tax filing, including federal, state, and local taxes. The platform stays up to date with changes in tax laws, ensuring businesses remain compliant and avoid penalties.

- Direct Deposit and Paycards: Employees can opt for direct deposit to their bank accounts or receive pay on Paycor’s prepaid paycards, offering greater flexibility in how they receive their earnings.

2. HR Management

Beyond payroll, Paycor also provides a variety of HR solutions that enable businesses to manage their workforce more effectively:

- Employee Self-Service: Paycor offers a self-service portal where employees can access their pay stubs, tax documents (like W-2s), and update personal information. This reduces administrative overhead for HR staff and empowers employees to manage their own data.

- Benefits Administration: Paycor simplifies benefits enrollment and management, making it easier for employees to choose and track their health, dental, and retirement benefits. The platform also helps businesses ensure they are compliant with regulations such as the Affordable Care Act (ACA).

- Time and Attendance: Paycor provides an integrated timekeeping system that tracks employee hours, overtime, and attendance. The system syncs with payroll to ensure accurate wage calculations and helps with compliance to labor laws.

3. Recruiting and Onboarding

The Paycor platform extends its capabilities to help businesses attract and retain top talent. It features:

- Recruitment Tools: Paycor’s recruitment module allows businesses to post job openings on multiple job boards, manage applicant tracking, and streamline the hiring process.

- Onboarding: Paycor’s onboarding tools help new hires get up to speed quickly, providing them with necessary documentation and access to company policies before their first day. This leads to a smoother transition and better retention of new employees.

4. Workforce Management

Managing a workforce involves more than just payroll. Paycor’s workforce management features help businesses track employee performance, training, and compliance. These include:

- Performance Management: Paycor allows managers to set goals, track performance, and conduct reviews. This helps foster a culture of continuous improvement and ensures employees meet company expectations.

- Learning Management: The platform offers tools for tracking employee training, certifications, and professional development, ensuring that the workforce remains skilled and compliant with industry standards.

5. Reporting and Analytics

Data-driven insights are essential for making informed business decisions. Paycor provides a range of reports and analytics tools that help businesses measure key metrics such as:

- Payroll Reports: Paycor’s payroll reports include detailed breakdowns of employee earnings, taxes, deductions, and employer contributions. These reports help businesses track labor costs and manage budgets.

- HR Metrics: Paycor also offers reports on employee turnover, recruitment, and performance, which help HR teams optimize workforce strategies and address any talent gaps.

- Compliance Reports: The platform generates reports that help businesses remain compliant with federal, state, and local labor laws, including ACA reporting and wage-and-hour compliance.

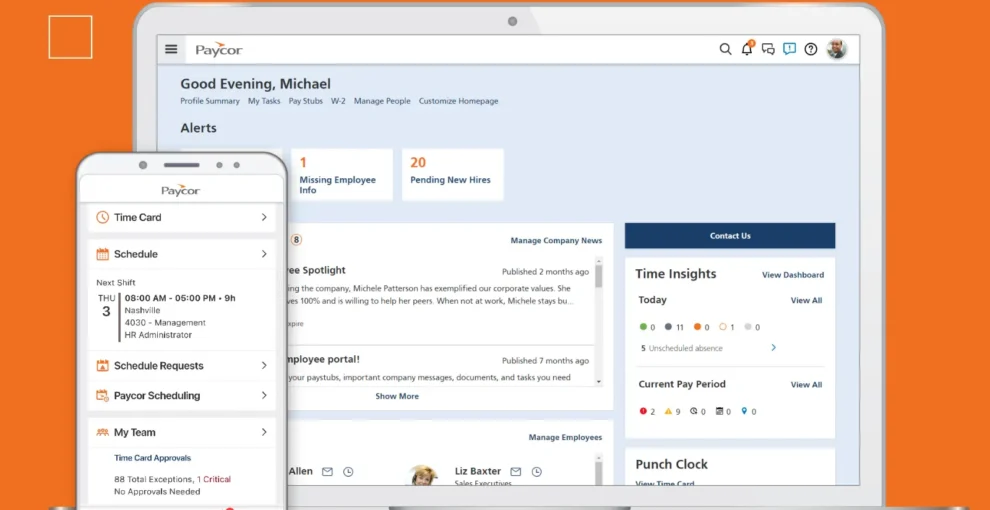

6. Mobile Access

As businesses become increasingly mobile, Paycor offers a mobile app that enables both employers and employees to manage payroll and HR tasks on the go. Employees can view their paychecks, request time off, and update personal information from their smartphones, while employers can approve time off requests, process payroll, and access key data from anywhere.

Benefits of Using Paycor

Paycor’s suite of tools offers several advantages for businesses looking to streamline their payroll and HR processes:

1. Time Savings

By automating payroll, time tracking, and HR processes, Paycor significantly reduces the amount of time businesses spend on administrative tasks. This allows HR professionals to focus on more strategic activities, such as employee development, recruitment, and engagement.

2. Compliance Assurance

One of the biggest challenges businesses face is keeping up with ever-changing tax laws and labor regulations. Paycor’s software is designed to keep businesses in compliance with federal, state, and local laws, reducing the risk of penalties for non-compliance. Features like automatic tax filing, ACA reporting, and audit-ready documentation ensure businesses stay ahead of regulatory requirements.

3. Accuracy and Reliability

Payroll errors can be costly, leading to employee dissatisfaction and potential legal issues. Paycor’s system reduces the risk of errors by automating calculations and syncing payroll with time and attendance data. This ensures employees are paid correctly and on time, every time.

4. Employee Engagement

Paycor enhances employee engagement by providing a self-service portal where employees can access their pay information, benefits, and training resources. This transparency helps build trust and satisfaction among employees, leading to improved retention rates.

5. Scalability

Whether you have a small team or a large, multi-location workforce, Paycor’s solutions scale with your business. The platform’s flexibility allows businesses to add new employees, adjust pay schedules, and adapt to changing needs as they grow.

Why Choose Paycor?

There are many payroll and HR solutions available on the market, but Paycor stands out for its user-friendly interface, comprehensive features, and commitment to compliance and accuracy. Whether you’re a small business just getting started or an established enterprise looking to streamline your operations, Paycor offers a solution that can be tailored to your needs.

Conclusion

Managing payroll and HR processes can be complex and time-consuming, but Paycor offers businesses a reliable and efficient solution. With its comprehensive features, including payroll processing, HR management, recruiting, performance tracking, and compliance reporting, Paycor helps businesses save time, reduce costs, and stay compliant with labor laws. The platform’s user-friendly interface, automation, and scalability make it an ideal choice for businesses of all sizes looking to optimize their payroll and HR functions. By leveraging Paycor’s tools, businesses can focus on what matters most: growing their business and engaging with their workforce.